With Hurricane season approaching around the corner, the Florida Office of Insurance Regulation encourages consumers to review your insurance policies, understand your coverages, and protect your home from the threat of flooding before the storm.

The resources included below will help consumers prepare for severe weather. OIR encourages consumers to continue monitoring this page for important updates throughout the storm season.

Hurricane Updates

Governor DeSantis has declared a State of Emergency for 41 counties in Florida for Hurricane Helene. Executive Order 24-209 is available here.

In coordination with the Florida Department of Health, OIR has distributed a notice to all health insurers, managed care organizations, and other health entities, reminding them they must comply with with provisions of section 252.358, Florida Statutes, which allows for early prescription refills in the event the Governor issues an Executive Order declaring a State of Emergency. This mandate remains in effect until the Governor’s Executive Order is rescinded or expires.

Hurricane Resources

Flood Insurance Information

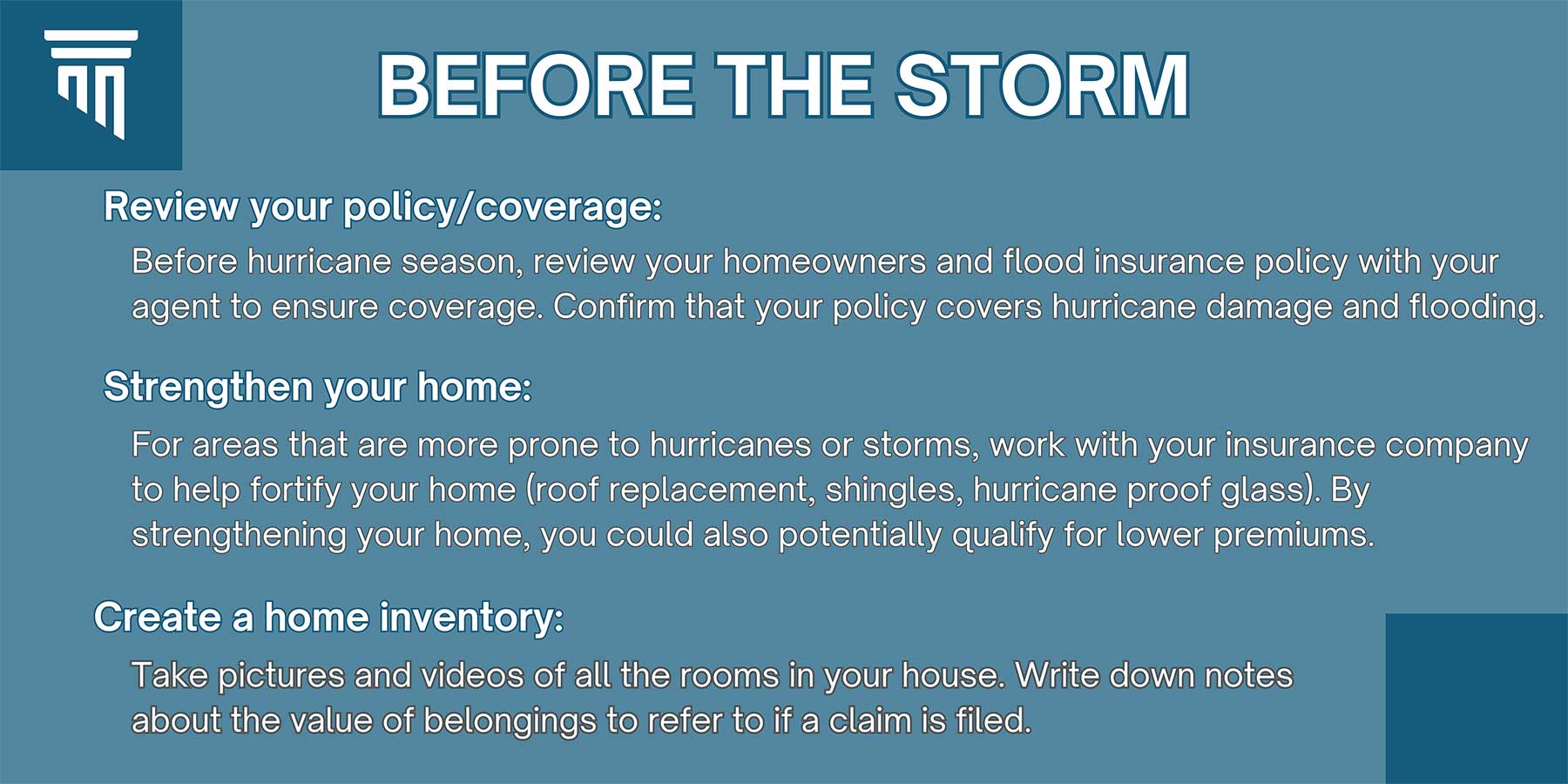

- OIR encourages consumers to make sure they are covered. Flooding is the nation's most common and costly natural disaster. Flood damages are not typically covered in a homeowners' insurance policy and flood coverage must be purchased separately or as an endorsement to their current policy. Even a small amount of water in a home can cost a very costly.

Create a Home Inventory

- In preparing for hurricane season it is important to maintain an inventory of your home. A home inventory is a list of significant items within the room, broken down by room, with an estimate of the item’s current value. These types of inventories can make it easier for you to file an accurate, detailed insurance claim in case your home is damaged or destroyed in a disaster. As part of the home inventory, you should include photos and proof of ownership. Once you have completed your home inventory, you should check with your insurer to determine if you need additional coverage

Gather Important Documents

- Be sure to gather your important documents such as your insurance policies, identification cards, and keep them in a secure location should you need to evacuate quickly.

Prepare an Emergency Kit

- OIR encourages consumers to be prepared before severe weather takes place. Preparing an emergency kit for hurricane or severe storm season is crucial as it ensures readiness for potential disruptions caused by these weather events. With essentials like non-perishable food, water, flashlights, batteries, and first aid supplies readily available, individuals can better navigate power outages, service interruptions, and evacuation orders.

Disaster Preparedness Tax Free Holidays

Governor Ron DeSantis announced two Disaster Preparedness Tax Free Holidays in the 2024 Budget. During this time Floridians are able and encouraged to purchase select disaster preparedness items tax free. The two tax holiday breaks are:

a3024ef50cb84ddfb7ae0bf77aa14d39.png?sfvrsn=ca5e4688_1)